Top deli performers

Several categories within deli prepared enjoyed some of the strongest sales increases within the perimeter, and sometimes the entire grocery store, in the past 12 months.

Big winners and their increases in dollars-per-buyer include:

- Deli prepared, 13.4%

- Deli sandwiches, 10.8%

- Deli prepared meats, 13.3%

- Deli soups, 14.1%

- Deli breakfast, 22.7%

- Deli pizza, 15.5%

A changing customer base

Getting on top of major demographic shifts in the United States will be crucial for grocers who hope to adapt and thrive.

Among the changes:

- The average US household has just 2.5 people, the fewest in history.

- 70% of households have no kids.

- 29% of household decision-makers are under 40.

- 17 states lost population in recent years, and more people moved to the South and West.

- 14% of the US population is foreign-born.

Inflation’s impact

- 96% of Americans are concerned about food inflation.

- 84% are making changes to adapt to higher prices.

- 43% are dining out less often.

- 19% plan to cook at home more — and, unlike a year and two years ago, that’s mainly due to inflation, not COVID.

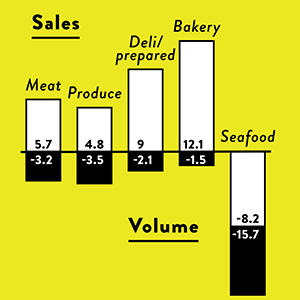

Higher sales, lower volumes — with deli and bakery leading the way

Source: Sosland Publishing Co.

Source: Sosland Publishing Co.Like most other food categories, perimeter departments are, with the exception of seafood, seeing sales increases but lower volumes in the current inflationary era.

Meat

- Sales: 5.7

- Volume: -3.2

Produce

- Sales: 4.8

- Volume: -3.5

Deli/prepared

- Sales: 9

- Volume: -2.1

Bakery

- Sales: 12.1

- Volume: -1.5

Seafood

- Sales: -8.2

- Volume: -15.7

Source: International Dairy, Deli, Bakery Association (IDDBA), IRI