ARLINGTON, VA. — Nearly half of shoppers put at least some effort into selecting plant-based food and beverages, and many expect to increase consumption in the future, according to data from FMI — The Food Industry Association’s inaugural “Power of Plant-Based” report.

The report provides a review of the plant-based topic broadly, covering naturally plant-based foods like fruits and vegetables as well as alternatives to animal-derived products.

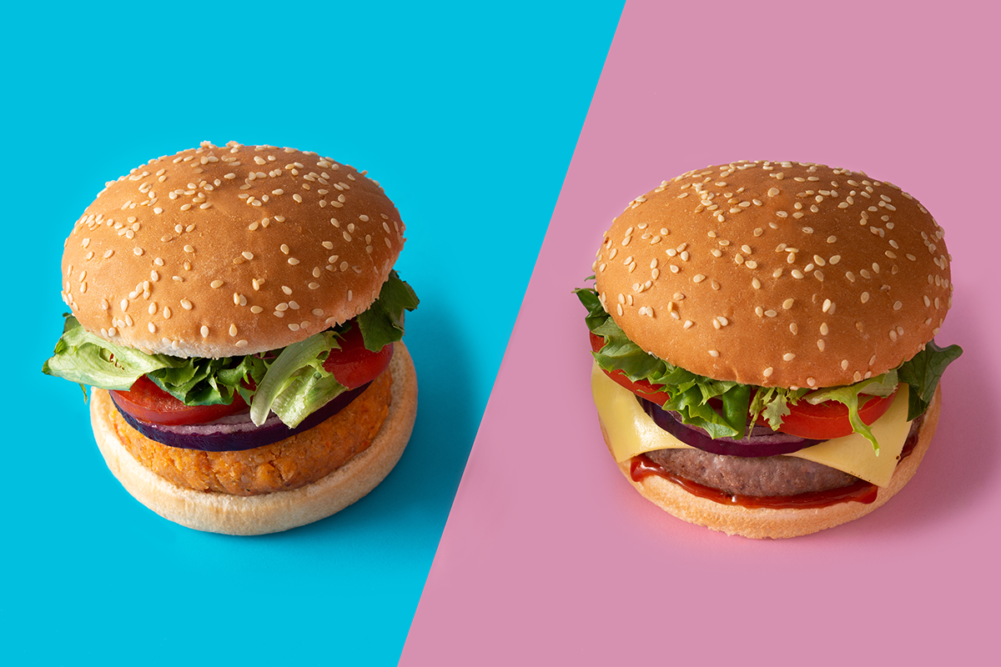

“More than 50% of shoppers at least occasionally eat a meat, dairy or seafood alternative, but dairy alternative sales are more than twice those of meat alternatives,” said Steve Markenson, director of research and insights for FMI. “The plant-based foods most likely to be regularly consumed by shoppers are naturally plant-based — fruits and vegetables (75%) and beans, nuts or grains (47%).”

A quarter of shoppers regularly consume milk alternatives and 21% regularly consume other dairy alternatives, according to FMI. Slightly less than 20% of shoppers regularly consume meat alternatives.

Around half of shoppers regularly or occasionally purchase starch or carb alternatives like chickpea pasta or cauliflower pizza crust. Soy products like tempeh or tofu and blended items that combine meat with beans or vegetables are consumed regularly or occasionally by a quarter of shoppers.

The report found consumption of plant-based food and beverages may be considerably higher in the future. Nearly one-in-three shoppers expect to increase consumption “a little,” and 16% expect to increase consumption “a lot.” Thirty-five percent of shoppers who regularly consume plant-based items said they will consume “a little more” and 27% said they will consume “a lot more” in the future.

Purchase drivers

The report highlighted the range of ways consumers think about and define plant-based food and beverages. The most frequent association was “healthy.” Consumers also associated words ranging from “vegan,” vegetarian,” “organic” and “natural” to “tasteless, “expensive” and “fake” with the term.

Some associations point to confusion or a lack of awareness about the attributes associated with existing products. Six-in-ten consumers said they are looking for fewer ingredients or minimal processing, even if that isn’t what many plant-based offerings are known for, according to the report. Organic is an important attribute for 40% of plant-based shoppers, but FMI noted that “organic isn’t particularly a selling point” for many products currently on the market.

Consumer choices may have less to do with what a product is called and more to do with how it fits into their lifestyle. Health was a primary driver for both meat and dairy alternatives. Taste was the other key driver across categories, while allergies and intolerances were a prominent factor for dairy alternatives.

“Our ethnographic research suggests consumers are seeking out plant-based foods and beverages primarily for both taste and nutrition,” said Krystal Register, senior director for health and well-being at FMI. “The food industry has an opportunity to provide guidance and educate consumers on overall healthy eating approaches that include plant-based options in alignment with the Dietary Guidelines.”

Those who tried plant-based meat and dairy products once or twice but did not continue said taste was the biggest reason.

Navigating the store

FMI asked shoppers if they know where to find plant-based products in their primary grocery store. Slightly more than half (54%) said they always know where to locate milk alternatives while slightly less than half (46%) said they always know where to locate other dairy alternatives. Just one-in-three said they were confident locating meat and seafood alternatives.

Some consumers assume plant-based items will be placed in a section near their animal-based counterparts. Others seek those items in dedicated plant-based displays. The topic of in-store location is important to consumers, but how those products are categorized remains inconsistent across retailers, according to FMI.

“There’s no consensus among shoppers about where to find plant-based alternatives, which demonstrates the opportunity for both cross-merchandising in addition to creative in-store messaging,” said Rick Stein, vice president of fresh foods at FMI. “For example, for meat alternatives, the top choice is not the meat department. It’s a designated plant-based food section and the frozen foods section, followed by the meat department.”