In early 2022, San Francisco-based fresh supply chain specialist Afresh Technologies announced it was partnering with Albertsons to help the retailer reduce waste, increase sales and provide its customers with the freshest foods.

Nearly a year later, Nathan Fenner, Afresh’s president, couldn’t be happier with the result.

“It’s going fantastically well, and we’re really excited what’s coming in 2023. It’s everything we hoped for and more, and it’s really validating our approach at the national level.”

Afresh, which also has partnerships with Winco, Save Mart, Bashas’, Cub and other retailers, has a big backup of other retailers looking to take advantage of the company’s Fresh Operating System platform.

Also on tap for 2023: Afresh will expand its services to seafood, meat and poultry and deli, Fenner said. To this point, its focus has been on produce, though the company has trialed other fresh perimeter departments on a limited basis.

“It’s the natural progression of our product,” Fenner said of the expansion into other perimeter departments. “The vision of our company has always been to build it for the entire fresh operation.”

Afresh’s customers and future customers have told the company they like the fact that Afresh built its platform exclusively for fresh, Fenner said. Other inventory management systems are built on the foundations of the center-store platforms that preceded them, in many cases by decades.

When the first inventory management software rolled out in the 1980s, fresh didn’t make up as a high percentage of sales as it does now, Fenner said. Also, it was much easier to manage center-store items than perishables.

It’s only been in recent years that technology breakthroughs have made fresh-centric systems feasible. That’s dovetailed beautifully with higher demand for fresh products and retailers’ putting more emphasis on it, Fenner said.

“For the first time, grocers have a really innovative purpose-built technology that’s well-suited for fresh departments. The fresh category is a strategic differentiator for retailers, but the tech was all designed for non-fresh categories. So we’ve seen a historical underserving of these departments.”

Afresh’s platform typically delivers at least 25% shrink reduction for its retail customers, Fenner said. Other platforms, he said, claim those kind of numbers, but their data is often cherry-picked and limited to a narrow window of time. Customers like that Afresh’s data covers the whole department over a significant period of time, he said.

In addition to that 25% number, which can make a huge difference for retailers working on tiny margins and in stiff competition with other players in their markets, Afresh’s platform also can lead to “significant sales increases” in fresh departments where it’s been implemented, Fenner said. Stores that use Afresh typically see a 2-4% increase in top-line revenue growth and have a 40% or more increase to their produce operating margin.

“It means fewer out-of-stocks, faster turns, and we believe it’s driving a better fresh experience.”

Retailers often have the mindset, Fenner said, that they can reduce shrink only by reducing inventory. With Afresh, they can reduce shrink and keep inventories full to prevent sales losses, he said.

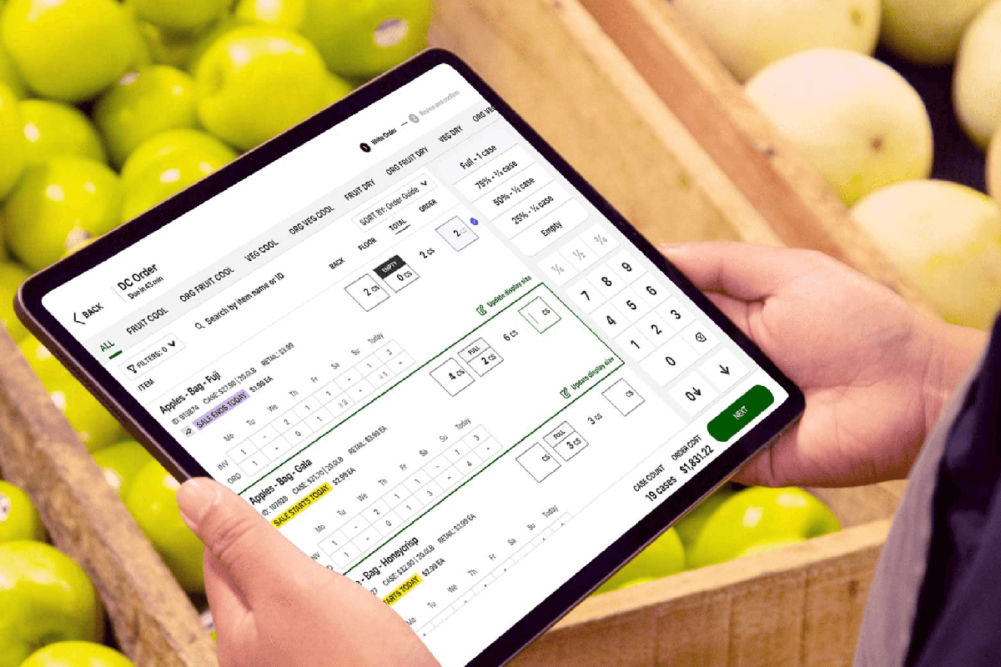

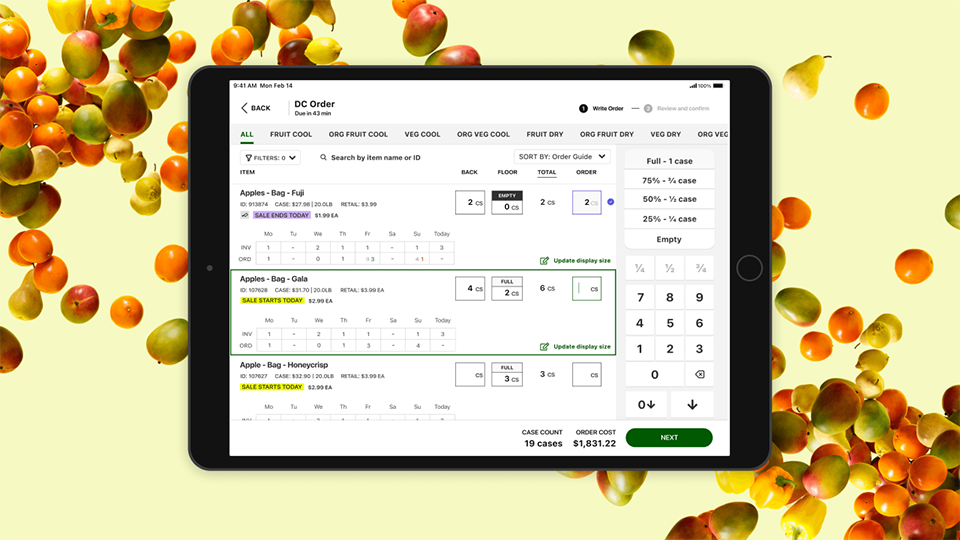

Retailers have also told Afresh that they like how intuitive and easy it is to use, Fenner said. That’s crucial in today’s tight labor environment, where skilled workers are hard to find and keep.

Source: Afresh Technologies

Source: Afresh Technologies