The holiday season is quickly approaching. The time is now for brands to develop strategies to connect with shoppers and land their products into carts during this highly competitive season.

Research from 84.51° has uncovered insights into shoppers’ spending habits, expectations and brand preferences for the holiday season.

Some key takeaways from our new 2023 holiday report include:

Shoppers expect holiday spending to be impacted by inflation but are willing to splurge

Based on the top-two results on a seven-point scale, 45% of shoppers said that inflation will very much impact their discretionary spending and 25% said it will greatly impact their holiday meal plans.

Although shoppers expect their buying power to be impacted by inflation, they’re still planning to splurge on certain items in the holiday season. Close to half (46%) of shoppers said they plan to splurge on gifts, 44% plan to splurge on limited edition or seasonal snack items and 42% intend to splurge on desserts.

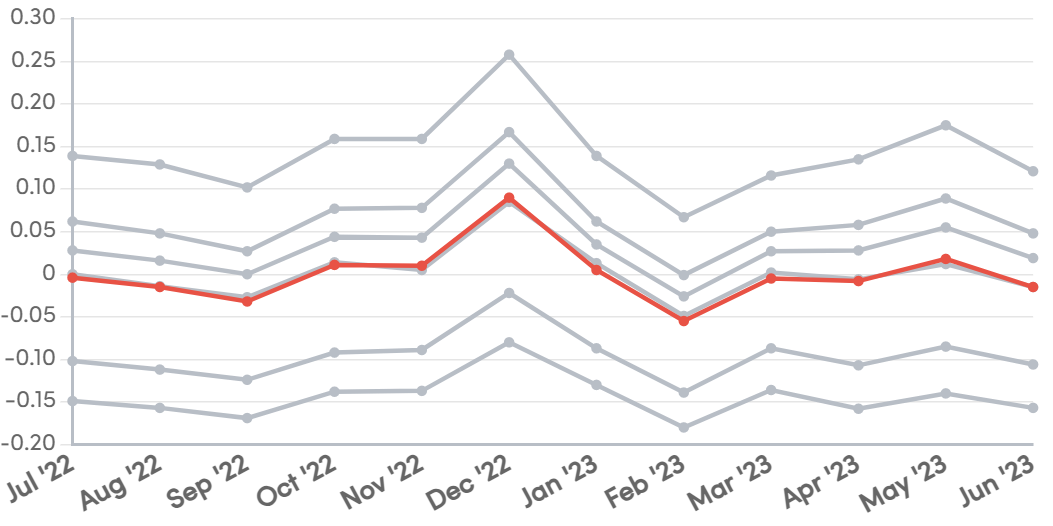

And as illustrated below, grocery spend surged across all income brackets this past December. These insights suggest that while customers will be mindful of their budget, brands have an opportunity to connect with motivated holiday shoppers and maximize the end-of-year spending peak.

Source: 84.51° Stratum, latest 12 months ending June 2023

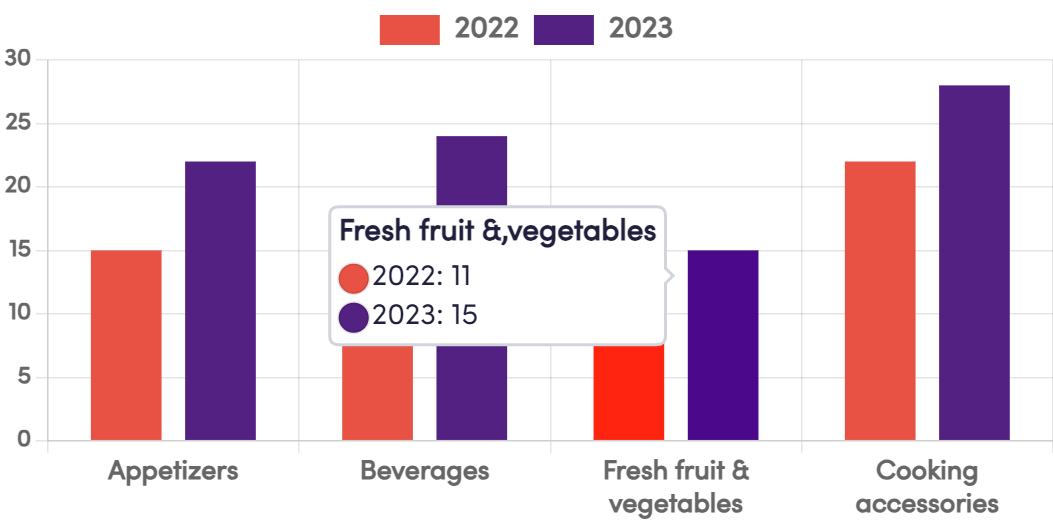

Source: 84.51° Stratum, latest 12 months ending June 2023Appetizers, beverages, fresh produce are on holiday shoppers’ omnichannel lists

While in-store holiday shopping remains dominant, shoppers are increasingly turning to online platforms to complement their traditional holiday shopping trips. Shoppers report that they plan to shop for appetizers, beverages, fresh produce, and cooking accessories both in-store and online more so than they did last year.

Base: Kroger Category Shoppers (n=400)

| Source: 84.51° Real Time Insights, April holiday survey 2022 & May holiday survey 2023Shoppers anticipate attending festive gatherings with a similar turnout as last year

Our research shows that holiday parties will be on par with last year, with 93% of shoppers planning to attend festive gatherings of the same size or larger than in 2022. With the average holiday celebration varying in size from five to at least 20 people, brands have an opportunity to provide meal ideas and gift recommendations that scale to diverse party needs.

For instance, brands selling products tailored to large groups, e.g., party-sized packages, family meals, bulk snacks, etc., can tailor these offerings for holiday campaigns. For other products, specific pairing ideas such as wine and cheese or a sandwich platter and salad could also be effective.

The holiday season calls for thoughtful messaging, competitive pricing and relevant promotions. With the right strategies, CPG brands can forge meaningful connections with customers during a highly competitive shopping season.

Download the full 2023 holiday report, “From tradition to transformation: Examining holiday shopping trends and evolving customer habits” for insights into holiday shoppers’ purchase habits, expectations, shifting brand preferences and much more.