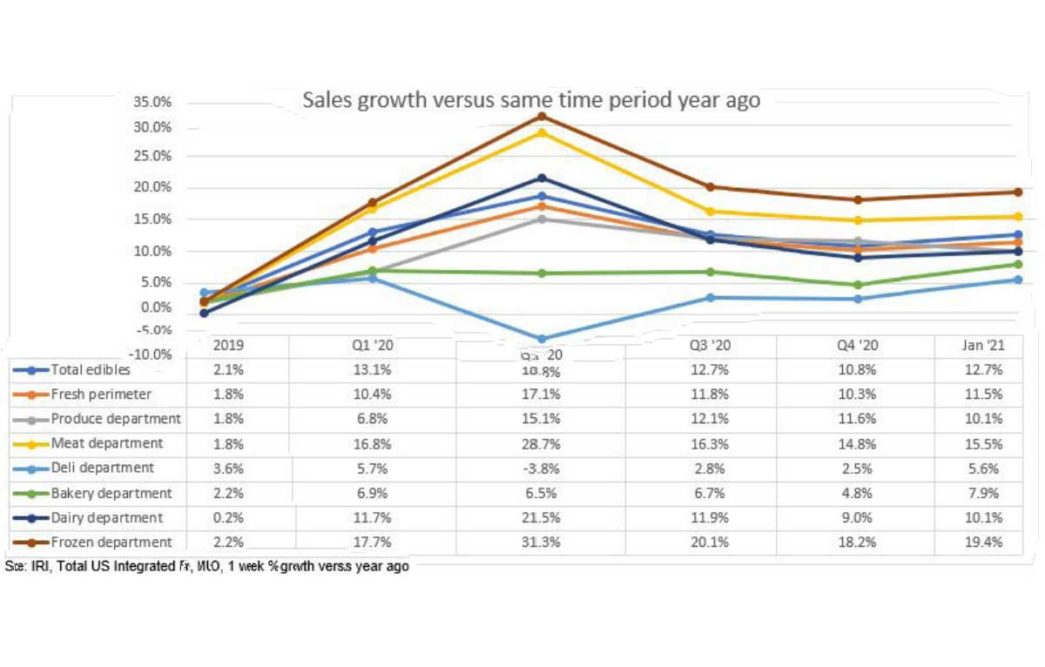

MADISON, WIS. – Consumers took a few more trips to the dairy, deli and bakery sections of grocery stores in January resulting in sales gains over the year-ago period, the International Dairy Deli Bakery Association (IDDBA), said in their most recent COVID-19 Impact report, which is a collaboration of IRI and 210 Analytics and IDDBA.

The first four weeks of January brought acceleration of sales across the store, according to the report, with the frozen and meat departments reporting the highest increases. Meanwhile, deli and bakery also saw robust increases over year-ago levels with deli seeing the highest sales gains since pre-COVID.

“The elevated level of new COVID-19 cases, the cold temperatures across much of the country and the continued high share of meals prepared at home brought additional dollars to retail,” said Jeremy Johnson, vice president of education for IDDBA. “This is an important signal that everyday and holiday demand are likely to sit well above year ago levels for a few more months, until we hit the spikes of 2020 — starting the week ending March 8.”

Deli recovery

Sales picked up in all areas of the deli during January with deli meat and cheese leading the way.

Deli meat sales (combined fixed and random weight) were very steady in dollars and volume, with January 2021 gains just slightly above year-ago levels, the COVID-19 Impact report said. Driving sales were grab & go (random weight but sliced for self-service) and pre-sliced options.

“Service sales continued to recover in January, climbing more than 1% ahead of 2020 levels,” the report said. “Service deli meat is, by far, the largest in dollar and volume sales. In volume, packaged lunch meat in the meat department is much bigger at 86 million lbs sold in January 2021 versus 64 million lbs in deli meat.”

Deli cheese dollar sales increased 18.2% year-over-year during December — up significantly from the fourth quarter results and more in line with the third quarter view. Service deli cheese showed a growth trend similar to that seen for deli meat with grab & go and pre-sliced options successfully growing sales.

“With some retailers still having the service deli shut down, sales are trailing 2019, though not by much,” the report stated. “Specialty cheese has been a big area of growth as well and size have become quite sizeable, at $376 million in January 2021. At home New Year’s celebrations as well as the elevated ingredient and snacking aspects of specialty cheese keep drawing shoppers into the deli section.”

The pandemic turned the prepared deli segment, a multi-year growth engine, into an area of loss with dollars down 9.2% or $1.8 billion, according to the report.

However, a bright spot for the segment was holiday meal solutions, including deli catering rings. Another important category is sides. All of this shows that consumers still need help with meal preparation especially during the holidays.

“Many consumers mix and match cooking from scratch along with convenience focused solutions and sides emerged as a strong contender for 2021 success,” said Jonna Parker, team lead Fresh at IRI.

Dairy building strong sales

“In 2020, the dairy department grew from being a $54 billion business to generating more than $61 billion – a $7 billion increase,” said Abrielle Backhaus, research coordinator with IDDBA. “January 2021 picked up where 2020 left off with great strength across dairy items, led by milk, cheese and eggs.”

Milk added $83 million in sales in January compared to a year ago, and natural cheese was the biggest growth driver for the department with a gain of $125 million to reach $939 million in January sales, the report stated.

Yogurt edged out eggs in January sales, but eggs added $37 million dollars in year-over-year January sales.

Boost in bakery

January sales in the bakery department increased 7.9% to $2.5 billion, which is $186 million more than bakery generated in January 2020.

“Bread and rolls were an area of strength in 2020, both in the bakery aisle and in the fresh perimeter,” Parker said. “This was also the first month when desserts/sweet snacks and morning bakery saw universal success.”

Looking ahead, IDDBA expects everyday demand and holiday occasions will continue to elevate sales in deli, dairy and bakery departments. And working from home will continue to be the norm for most Americans. IRI shopper research found that 44% of employed Americans expect to work from home at least once a week after the vaccine is widely distributed and restrictions are lifted.