First it was because of the pandemic, now it’s inflation.

Whatever the cause, Americans are shifting their food dollars from foodservice to retail, and that’s unlikely to change in the coming year.

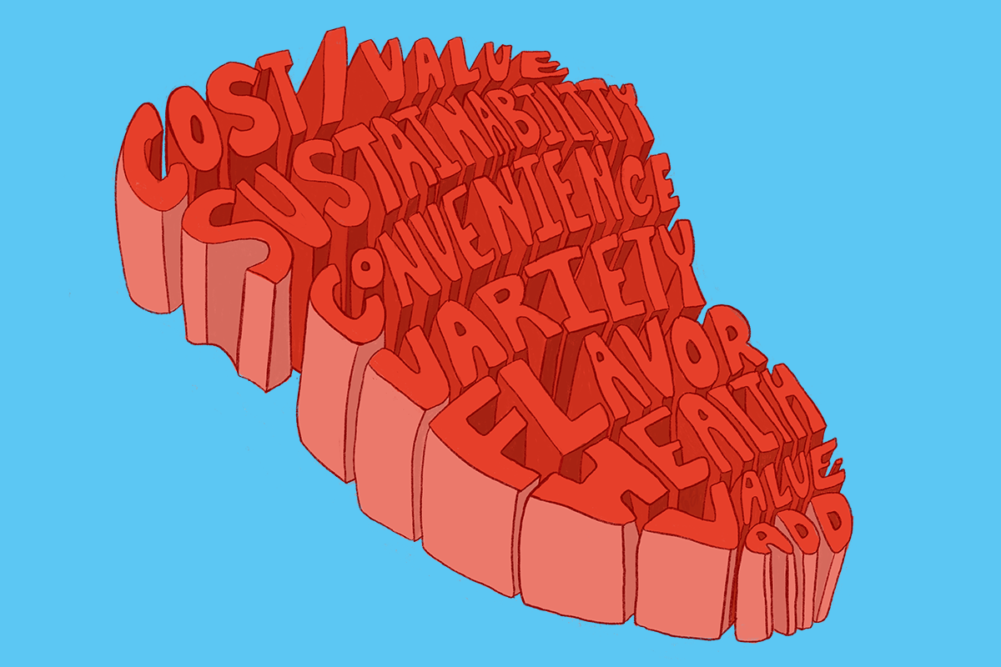

And when it comes to fresh meat and poultry products, retailers have a huge opportunity to tap into consumer demand not only for value, but for convenience, variety, health and companies whose values align with their own.

The challenge will be finding the right formula to combine so many different wants and needs.

“Consumers are cooking many of their meals at home and we don’t anticipate that this trend will change at the start of 2024,” said Monica Camarin, senior brand manager for Prairie Fresh.

Pork is perfect for this trend, Camarin said. It doesn’t cost as much as other meats and it’s well-suited for consumers looking to “maximize culinary creativity.”

The Prairie Fresh portfolio, which includes Prairie Fresh USA Prime and Prairie Fresh Signature products, offers a variety of cuts and products that cater to many consumer preferences and cooking levels, she said.

“Shoppers are on the hunt for high-value products that are nutritious and delicious yet don’t break the bank. Pork is an excellent choice for value-minded shoppers. With the variety of lean cuts available at exceptional price points, health benefits and culinary versatility, it’s a wholesome protein source that anyone will be confident serving their family.”

Price — and value

Jake Fazio, vice president of retail sales for Niman Ranch, characterizes the current dominant consumer attitude toward fresh meat purchases as a “having your cake and eating it too” phenomenon.

“They’re certainly keeping an eye on their grocery budgets and looking for ways to save when possible, but without compromising on quality or their values.”

For instance, demand for claims on meat has been climbing for years and should continue in 2024, despite inflationary pressures.

“It’s really exciting to see consumer values, particularly with younger generations, driving growth,” Fazio said. “Millennials and Gen Z are shopping with their values.”

That means supporting brands, like Niman Ranch, that offer humanely raised, antibiotic-free meats produced sustainably by independent family farmers.

“Consumers want to know the story of their food and to feel good about their purchases,” Fazio said. “Transparency is critical.”

Camarin agreed that price won’t be the only thing on consumers’ minds in 2024. Convenience is still at the top of the list, even if that means spending a bit more.

Pre-seasoned products like Prairie Fresh Signature, for instance, are a simple way for shoppers to reduce the number of items to purchase to prepare a wholesome and flavorful meal, Camarin said.

“Value-added lines deliver convenience and quality in one package for a hassle-free home-cooked meal.”

Prairie Fresh has many new products in the pipeline in 2024 that will continue to grow the company’s value-added product roster.

When it comes to flavor trends, there’s nothing hotter than spicy, Camarin said.

Prairie Fresh is tapping into the demand for all things spicy with its new Prairie Fresh Signature Nashville Hot pork loin filet.

“It’s an unexpected twist on a popular flavor profile,” Camarin said.

Simpler is better

In 2024, Niman Ranch will streamline some of its retail offerings.

The company’s customers, Fazio said, are looking for more simplicity. Offering a mix of products that are guaranteed to drive volume with low risk will be key for Niman Ranch.

“Unless it’s a category disruptor or it’s filling a gap, our customers really want to stick with the tried and true options.”

Expect this year to be a “grind economy,” Fazio said. Ground beef and pork will be top sellers, as consumers continue to watch their budgets while still being able to buy affordable, premium meats for simple meal time solutions.

Niman Ranch’s sausage category, meanwhile, will continue to provide great consumer value without sacrificing on the claims more and more people are looking for — look for it to be big in 2024.

Also in 2024, Niman Ranch will grow its partnership with Certified Angus Beef, Fazio said.

The companies have been partners for years. In 2023, they partnered on a grass-fed beef program, a unique offering in the marketplace, Fazio said, that provides something fresh to the grass-fed category.

“Grass-fed beef has been notoriously hit or miss when it comes to quality—the Niman Ranch and CAB partnership cracked the code on reliably delicious domestic grass-fed beef.”

Niman Ranch will also continue to expand its retail Iberian Duroc pork program in the coming year.

As with beef, pork is a category, Fazio said, where consumers are looking for meat options that deliver great quality and packaging that clearly communicates the premium message.

The tagline on Iberian Duroc products is, “Restaurant Quality Pork at Home,” and the “gilded and lux” design of the packs, as Fazio describes it, communicates the premium message effectively.

Sustainable solutions

Sustainability will be a major point of focus in 2024, said Lori Dunn, vice president of retail sales for Thomas Foods International USA.

The company is looking at new products and ways to maximize utilization of all the products and resources it has available.

It’s also conducting life cycle analysis for its products to share carbon footprint information specific to its unique livestock raising practices.

“We’re very excited by the early data and indicators coming out of that study, and look forward to sharing more,” Dunn said. “We continue to seek and experiment with sustainable packaging options and will explore every opportunity until we find the right fit for our customers.”

Thomas Foods is also investing in sustainable infrastructure. The company’s new beef processing plant in Australia, for instance, has state of the art climate-friendly features like methane digesters, solar panels, hyper efficient refrigeration and robotics that minimize the production footprint.

Look out for lamb

In addition to healthier products, consumers in 2024 are looking for inspiration and variety in their meal preparation, Dunn said. Thomas Foods has answers for that, too.

“As the US population continues to diversify, and as people continue to experiment with new cuts, proteins and preparation methods, we’ve seen large increases in our lamb and goat product sales.”

Lamb is still in the “adoption” stage in the US, but during the pandemic, when people were preparing most of their meals at home, lamb sales benefited when recipe fatigue set in.

“Once they try it at home, consumers realize how easy lamb is to cook, how delicious it is and that it’s a good value and readily available,” Dunn said. “For retailers that have an underdeveloped lamb presence in their case, now is the time to re-examine that.”

More than ever, it’s important for grocery meat departments to meet the needs of all their shoppers.

Thomas Foods works with its retail partners to build a strong strategy around their imported products, which allows them to diversify their offerings in the meat case, Dunn said.

“Our customers are seeing success by leveraging all their resources and offering our premium imported products alongside their USDA Choice, Prime and other domestic products, so there’s something for everyone in the case. Our focus on customization, with an emphasis on private labeling, allows us to meet them where they are and help them maximize their opportunities for growth.”

This article is an excerpt from the February 2024 issue of Supermarket Perimeter. You can read the entire Meat Trends feature and more in the digital edition here.