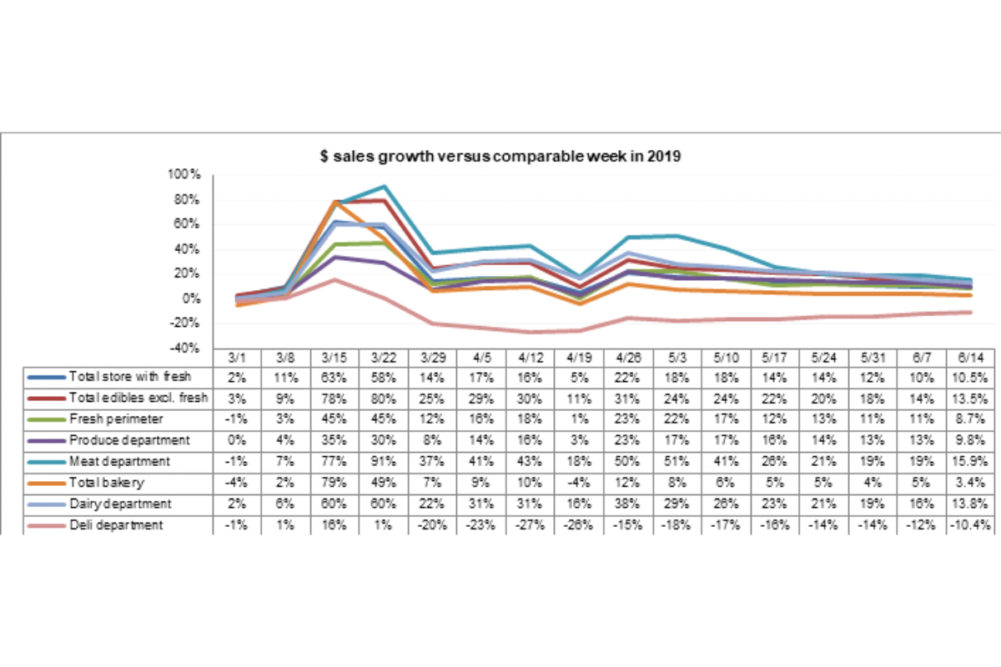

SAN ANTONIO – Although above-average sales across the meat, dairy and produce departments continued into the second week of June, sales numbers are on the downtrend compared to the last several weeks.

According to the latest data from 210 Analytics and IRI, the total fresh perimeter experienced an 8.7% jump in sales over the same timeframe in 2019 the week ending on June 14, compared to an 11% bump the two weeks previous.

“Grocery retailing has gone through an unprecedented amount of change over the past three months,” said Jeremy Johnson, vice president of education for the International Dairy Deli Bakery Association (IDDBA). “Many of our members in dairy and packaged baked goods have seen increases in buyers, trips and baskets. Consumers engaged with categories, products and brands they had never bought or not bought in years. The key to retention in all these areas is the value proposition, particularly as prices are rising across the store.

The dairy department experienced a 13.8% gain in dollar sales compared to 2019. Top performers in the category were eggs (up 25.8%), natural cheese (up 20%) and whipped topping (up 19.8%).

Like in previous weeks, the bakery and deli departments were still struggling in the week leading up to June 14, but the categories are improving compared to previous weeks. The deli department continues to see mixed results. Overall, department sales were down 10.4% the second week of June compared to a 12% decrease the first week of the month. Deli cheese was up 12.5%, deli meat was up by 8.8% and deli prepared foods were down 23.5%.

“Finding the right items suitable for packaged sales versus self-serve is key in rebuilding assortment in deli-prepared,” said Eric Richard, industry relations coordinator with IDDBA. “Store trips, evening activities, working away from home and many more areas that were highly affected by the pandemic are slowly starting to normalize. As commuting and out-of-the-home activities start to gear up, it is important to answer the demand for convenient, ready-to-eat meals in deli prepared with wider, relevant assortment while addressing consumers’ new normal as it relates to changed self-service preferences.”

Instore bakeries continued to see lower sales than normal with the whole department down 13.4% the week of June 14. Within the department donuts (down 45.3%), rolls (down 11.4%) and cakes (down 13%) are most impacting the category. Bread and croissants continued to perform well, up 5.9% and 8.9%, respectively.

Still a strong performer, the meat category in the second week of June totaled dollar sales 15.9% above 2019 sales. Although it’s important to note that volume sales gains were only up 0.9% for the category, and the heightened dollar sales continue to derive from enhanced meat prices across the category.

Dollar wise, lamb (up 33.5%) and turkey (up 20.9%) were the top performing meats. Beef was up 16.1%, chicken was up 13.4% and pork was up 16.9%.

“Plants continue to run at nearly full capacity and production is ahead of last year,” said Christine McCracken, executive director of food and agribusiness for Rabobank. “Beef and chicken harvest were both down from year-ago levels, whereas hog harvest is averaging more than 5% ahead of the 2019 pace. An increase of 2-3% in average animal weights was more impactful, however, resulting in an increase in production of all three major proteins. Beef production was up 1.5% for the week versus year-ago, whereas pork and chicken were up 8% and 1% respectively.”

“However,” she continued, “the mix of products remains unfavorable as processors are unable to fully convert carcasses given ongoing labor and distancing measures. This has left a surplus of bone-in products in combos that are difficult for retailers to move.”

In the produce category dollar sales were up 9.8%. Fresh vegetables are still outperforming fresh fruit, with vegetable sales up 14.1% and fruit sales up 6.1%. The top performers in the department were oranges (up 63.9%), cherries (up 45.7%) and tomatoes (up 24.3%). Cucumbers, peppers and mushrooms also saw sales numbers elevated by 20% or more.

“Seemingly, fresh produce has entered into a more consistent sales trend over the past four weeks,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “However, looking deeper, inflation is also rising in produce, fresh, frozen and canned. While the two big summer holidays, Father’s Day and July 4th, have the ability to significantly boost produce sales at retail, states are continuing to open more widely. It will be interesting to see how consumers re-engage, and we will be watching demand on key items. Retailers are gearing up for the strong summer season with fruit taking center stage now through Labor Day.”