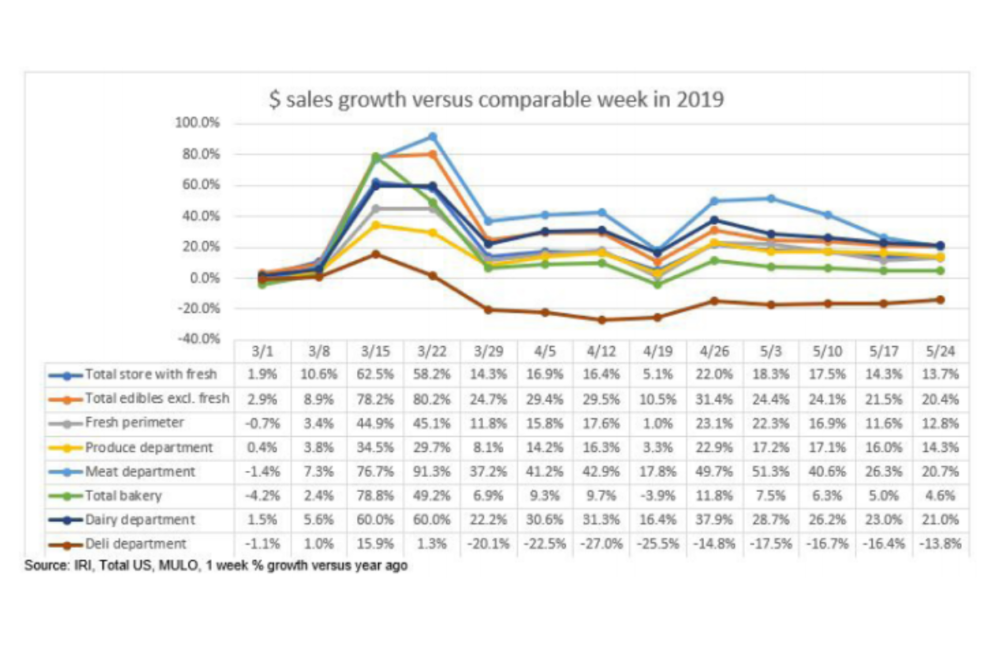

SAN ANTONIO – Leading up to Memorial Day celebrations, the end of May often brings the summer grilling season, and with it, significant sales boosts. That may be why compared to the same timeframe in 2019, data from 210 Analytics and IRI shows the week ending on May 24 saw the lowest fresh perimeter sales gain since Easter week, with an overall gain of 12.8%.

For the first time, the dairy department outperformed the meat department with a 21% gain in dollar sales compared to 2019. Top performers in the category were butter (up 39.6%), eggs (up 34.4%) and whipped toppings (up 34.1%). Natural cheese was up 29.1%, while processed cheese was up 18.2%.

“Dairy sales gains continued to sit more than 20% above the 2019 levels,” said Abrielle Backhaus, Research Coordinator with the International Dairy Deli Bakery Association (IDDBA). “Importantly, all areas within dairy contributed to the department’s success, including yogurt which, had its highest gain since late April. Strong growth continued to come from butter, eggs and cheese. As ingredients to meal occasions from breakfast to dinner, these types of gains indicate that America continues to cook and bake, and that is an exciting prospect for the weeks and months to come for food retail.”

Coming into the week of May 24, dollar sales in the meat department were elevated by 20.7%. Turkey (up 46.1%) and beef (up 39.3%) were the top performing meats. Chicken was up 23.8%, pork was up 35.2% and lamb was up 36.6%.

There remained a significant gap between dollars and volume sales growth, with the entire meat category seeing volume sales up by 5.1%. The widest gap among products was a 18.9% gap between beef dollar and volume sales followed by an 15% gap for pork and a 9.9% gap for lamb.

“US beef production was only 8% behind year-ago levels during the holiday-shortened week, while pork production was 6% behind last year’s pace,” said Christine McCracken, executive director of food and agribusiness for Rabobank. “Labor availability remains a challenge throughout the industry, forcing some plants to forgo deboning and other value-added activity. The chicken industry faced limited disruption this past week with ample labor and plants able to run on Saturdays to maintain production volumes. Chicken supplies will soon tighten however, as production cuts in April and May will begin to limit availability.”

Produce dollar sales were up 14.3%. Fresh vegetables are still outperforming fresh fruit, with vegetable sales up 20% and fruit sales up 9.5%. The top performers in the department were oranges (up 78.6%), cherries (up 33.2%) and potatoes (up 32.8%). Peppers and tomatoes also saw sales numbers elevated by 20% or more.

“Memorial Day week was an important gauge for me to see if summer fruits and vegetables got off to a strong start,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “While we are seeing a bit of erosion in the growth numbers each week, total fresh produce continued to hold in the mid-teens, a very welcome pattern for retailers across the country. At the same time, there are many indicators that restaurant demand is strengthening, including a rising number of dinner reservations on OpenTable and continued strong takeout statistics from DoorDash, Uber Eats, Grubhub and others.”

Like in previous weeks, the bakery and deli departments were still struggling in the week leading up to May 24. The deli department continues to see mixed results. Overall, department sales were down 13.8%. Deli cheese was up at 13.4%, deli meat was up by 4.8% and deli prepared foods were down 27.4%.

“More and more states are allowing restaurants to reopen dine-in facilities which will change the already disrupted demand landscape for deli-prepared offerings yet again,” said Eric Richard, industry relations coordinator with IDDBA. “How the dinner dollar is spent and will be spent in the next few months continues to be in flux as frozen foods have seen enormous strength.”

Instore bakeries continued to see lower sales than normal with the whole department down 15.2% the week of May 24. Within the department donuts (down 47.4%), cakes (down 17%) and rolls (down 13%) are most impacting the category. Bread and croissants continued to perform well, up 9.2% and 5.6%, respectively.