The wholesale baking industry ended 2021 on a largely positive note. That’s according to the results of BEMA Intel’s data for Q4 of 2021.

The Member Pulse Survey, which asks bakery equipment manufacturers to offer their outlook, showed that 98% of respondents had a positive outlook on the United States bakery equipment manufacturing industry, and 96% were positive about the global industry’s outlook. The US outlook had improved by three percentage points, furthering a trend of growing positive outlook since Q2 of 2020 when BEMA began the quarterly survey.

When looking at their own business outlooks, bakery equipment manufacturers see nothing but sunshine with 100% reporting positivity about the next six months of their business, which they are currently experiencing. One hundred percent of respondents were also positive about both the industrial/commercial channel and distributor channel.

“Demand continues to be up, which places pressure on supply,” said Tim Cook, chief executive officer of Linxis Group and chairman of BEMA. “Bakers are increasing capacity to handle this new level of demand.”

Despite price increases being passed to the consumer, their demand for baked goods remains strong. IRI data collected by BEMA shows that total commercial aisle bakery dollar sales continue to rise while unit sales hold steady from Q3 to Q4, suggesting the price increases aren’t deterring consumers.

“Even with price increases, consumers are not scaling back overall,” said Jennifer Lindsey, vice president of marketing, Corbion. “I don’t think bakery will take as much of a hit as other food categories as consumers deal with rising costs because it’s still a relatively low price per unit comparatively.”

Even the in-store bakery continues to recover from those early days of the coronavirus (COVID-19) pandemic with dollar sales up in Q4 and unit sales slightly up from Q3.

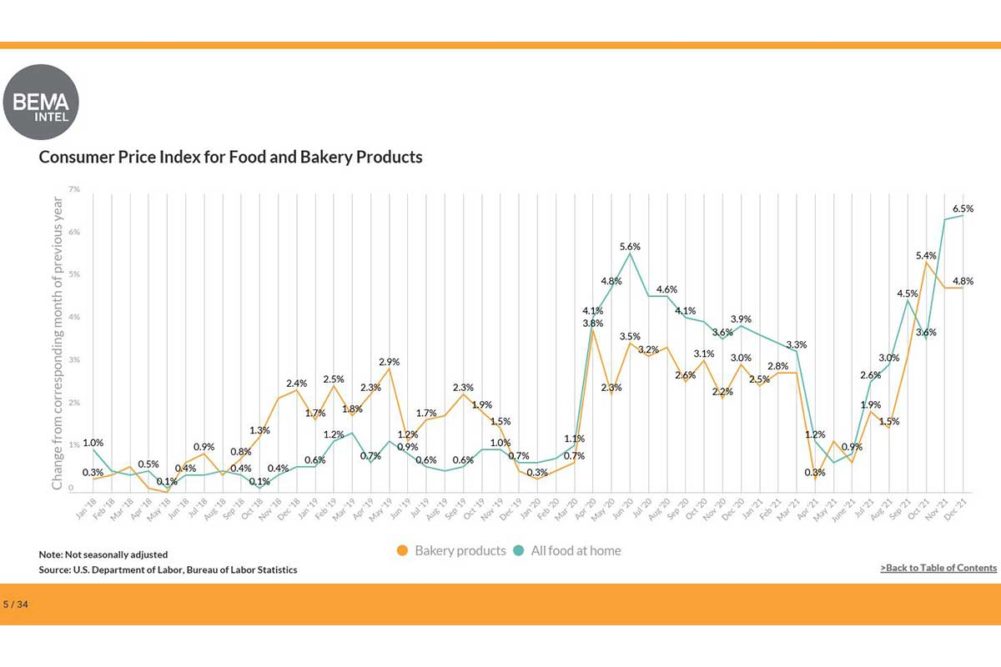

The overall trend for CPI for bakery products is moving up and reflecting those price increases. Since August 2021, CPI has gone from 1.5% to 5.4% to 4.8%.

“What this is telling me, and reflecting back on Q3 commentary, is the baking industry is starting to see effects of passing on price increases at retail,” Ms. Lindsey explained. “The overall food industry is still outpacing bakery in the CPI, but the net trend for bakery is good. Yes, there is a dip in December, but one point does not make a trend as we say. We should be reviewing over time.”

That’s great news for the baking industry, which continues to grapple with rising input costs in ingredients, fuel and transportation costs, and labor. Diesel fuel alone has seen a 38% increase, and though there was a dip in December, Ms. Lindsey pointed out that we already know that decline wasn’t indicative of a trend.

“Nothing is escaping the squeeze, and it is a storm of weather, drought, supply chain and logistics,” she said.

Bakery equipment manufacturers also continue to cite these issues as their main challenges.

“So far equipment manufacturers and bakers, working together, have managed through these challenges in an admirable way,” Mr. Cook said. “Certainly not without struggle and inconvenience, but suppliers have been very creative in their sourcing and staffing efforts, and bakers have been supportive by being flexible in how projects are staged and executed.”

The war in Ukraine is not reflected in these numbers, but it can only mean more disruption.

“It’s just more disruption with supply chain for raw materials and cost,” Ms. Lindsey said. “The only way I can see to maintain that is for price increases to continue.”