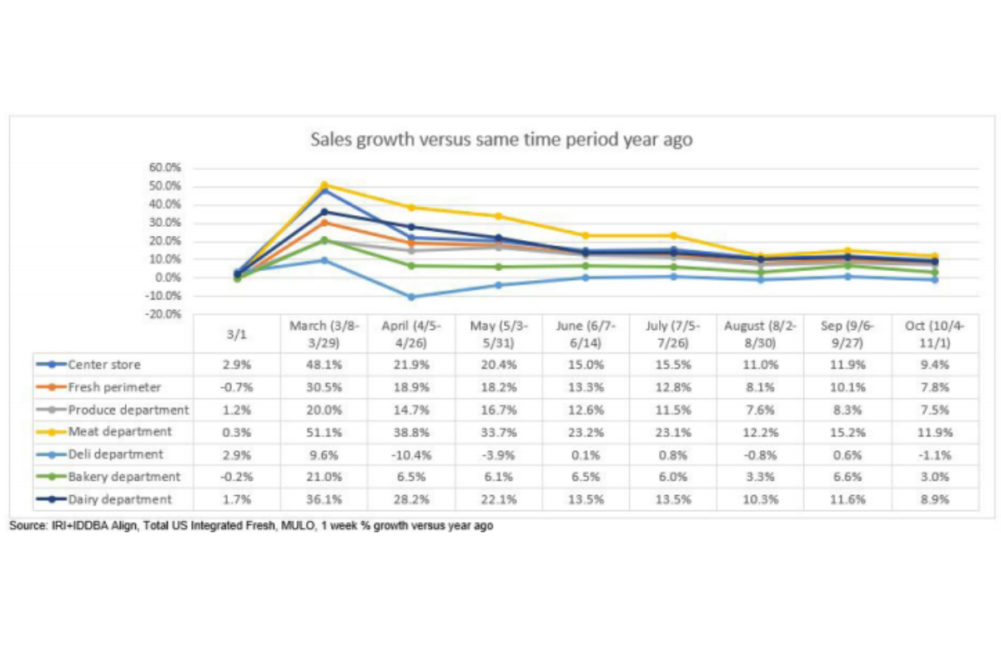

SAN ANTONIO - The latest monthly COVID-19 impact reports put together by 210 Analytics and IRI shows that perimeter sales gains were down in October compared to previous months, but still elevated above 2019 numbers. In the month of October, perimeter sales came in 7.8% above 2019 sales. In September the perimeter saw an 11.6% gain.

“According to IRI’s latest survey wave of primary shoppers in October, many shoppers are still working from home, have kids home in virtual schooling or are dealing with furloughs and unemployment, or a mix of all,” said Jonna Parker, team lead of fresh for IRI. “While certainly some of the food dollars have moved back to foodservice, we continue to see a high share of meals being prepared and consumed at the home. And sales patterns continue to evolve with a move to a little more convenience on the one hand, but money-saving measures on the other.”

Of the fresh departments, meat continued to see the highest year-over-year growth with dollar sales up 11.8%. Dollar wise, lamb (up 30%) was the top performing meat. Beef was up 14.8%, chicken was up 6.3%, turkey was up 9.2% and pork was up 9.7%.

“Everyday demand continues to hold between 10% and 15% above year ago levels as new COVID-19 case counts continue to rise and fall in different regions of the country,” said Anne-Marie Roerink, president of 210 Analytics. “However, renewed shelter-in-place restrictions and rising COVID-19 cases are likely to push more dollars to food retail once more. Additionally, the comeback of restaurants is hampered by colder temperatures in northern states. Aided by the effect of online sales, trip reduction, virtual schooling and working-from-home, meat sales are likely to remain well above 2019 levels for many weeks to come. However, holiday demand is likely going to be very different.”

The dairy department was elevated 8.9% in the month of October. Sour cream saw the highest gain in the category at 18.3%, followed by whipped toppings at 17.7% and yogurt at 13.7%.

“October marked the first month in which the dairy department registered single-digit versus double-digit dollar gains,” said Abrielle Backhaus, Research Coordinator with IDDBA. “However, all areas within dairy saw positive gains in October versus year ago. Milk and natural cheese were the two dominant players, generating around $1 billion in the five-week period, each. As in previous months, the deli department is still seeing mixed results, but signs of recovery are evident as the department came in just 4.7% below 2019 sales numbers. Deli prepared still experienced the hardest hit in September, coming in at 17.3% below 2019 sales. Deli meat was 12.2% above and deli cheese 13.2% above.”

The deli department continues to see mixed results. Deli cheese and meat saw gains of 14.4% and 10.5%, respectively. While deli prepared and deli entertaining saw losses of 10.3% and 0.4%, respectively—an improvement from previous months.

“Holiday meal solutions can be a great win for retailers,” said Eric Richard, industry relations coordinator with IDDBA. “We saw it at Easter and a number of the summer holidays as well. Thinking about the fact that most Americans have been cooking way more meals in recent months than they did before, there will likely to be increased demand to outsource the preparation of the Thanksgiving meal.”

Fresh bakery sales also saw mixed results in October.

“As seen throughout the pandemic, the more functional items of breads and rolls are mostly trending above year-ago levels,” said Roerink. “But desserts, sweet snacks and breakfast items continued to be below 2019 sales trends. These results are affected by the closing down of bulk, self-serve sections as well as the very different nature of celebrations and gatherings amid the pandemic.”