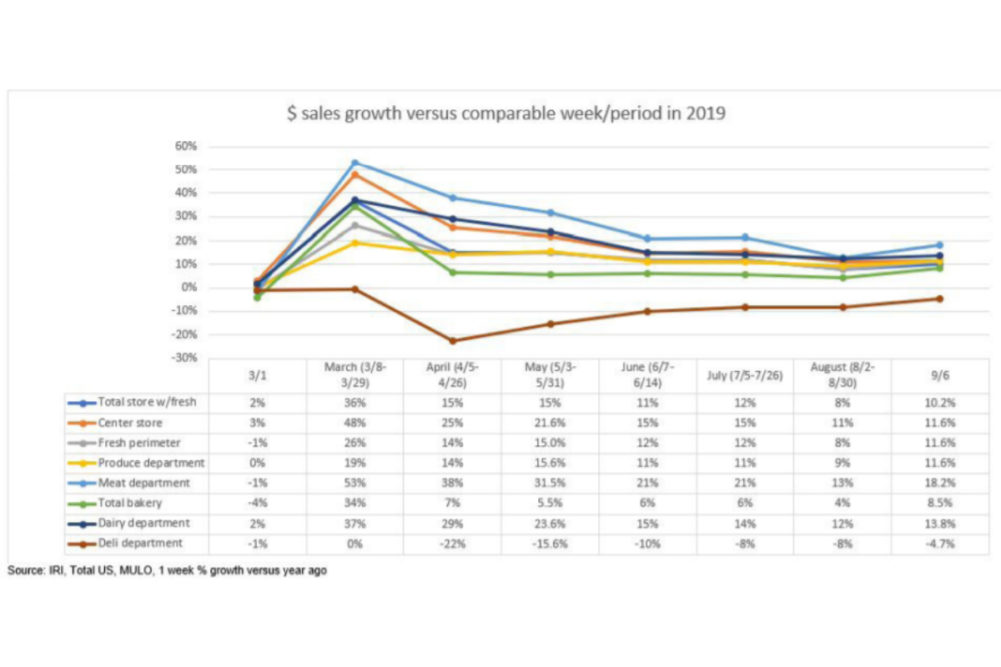

MADISON, WIS. - The latest monthly COVID-19 impact report released by the International Dairy Deli Bakery Association (IDDBA) and put together by 210 Analytics and IRI shows that in the month of September, the fresh perimeter came in 11.6% above year-over-year sales. In August, the perimeter was elevated by 8%.

“According to IRI’s latest survey wave of primary shoppers in late September, anxiety levels over in-store visits have decreased significantly, with 58% of shoppers feeling relaxed,” said Jonna Parker, team lead of fresh for IRI. “This is an improvement of 15% since July. Additionally, two-thirds of shoppers now spend about the same amount of time shopping in the store as they did before the pandemic. Browsing for different items to try is also up a few points. These are all encouraging signs for new product launches and in-store merchandising once more catching the attention of shoppers.”

IDDBA’s report does a deep dive into sales in the dairy, deli and bakery categories. Of the three, the dairy department performed the best with a 13.8% gain in dollar sales year-over-year in September. Top performers in the category were whipped topping (25.4%), cream cheese (up 25.2%) and natural cheese (up 19.1%).

“Dairy now has seven consecutive months of double-digit dollar gains,” said Abrielle Backhaus, research coordinator with IDDBA. “All areas within dairy saw positive gains in September versus year ago. Natural cheese and milk were the two dominant players in the dairy department during September, generating upwards of $1 billion in the four-week period, each. While natural cheese gained 19.1% over last year’s levels during the month of September, milk dropped to the high single digits, at +9.7%. The highest percentage gains in September were recorded by cream cheese and whipped toppings, though both are smaller sellers.”

As in previous months, the deli department is still seeing mixed results, but signs of recovery are evident as the department came in just 4.7% below 2019 sales numbers. Deli prepared still experienced the hardest hit in September, coming in at 17.3% below 2019 sales. Deli meat was 12.2% above and deli cheese 13.2% above.

“The work from home movement that started the middle of March and persists today, combined with many students partaking in virtual education from home, is dampening ready-to-eat refrigerated lunch solutions,” said Eric Richard, industry relations coordinator with IDDBA. “On the other hand, the idea of combining scratch with convenience-focused items appears to be popular, with refrigerated side dishes up 21.7% over year ago levels.”

Bakery sales were still just under last year’s numbers in September, coming in at 3% below 2019. Donuts held down the category, coming in at 30.8% below 2019 levels and rolls were down 7.3%. Croissants and bread were the best performer in the category, both up 12.6%.

“The next monthly report will be available mid-November, covering the month of October,” said Anne-Marie Roerink, president of 210 Analytics and author of the report. “Excluding weeks that were affected by the 2019 or 2020 holiday demand, everyday demand is normalizing at around 10-12% above year ago levels for dairy, deli cheese and deli meat. Much like the other pandemic-affected holidays to date, the winter holidays are expected to see vastly different demand.”

The full report can be viewed here.