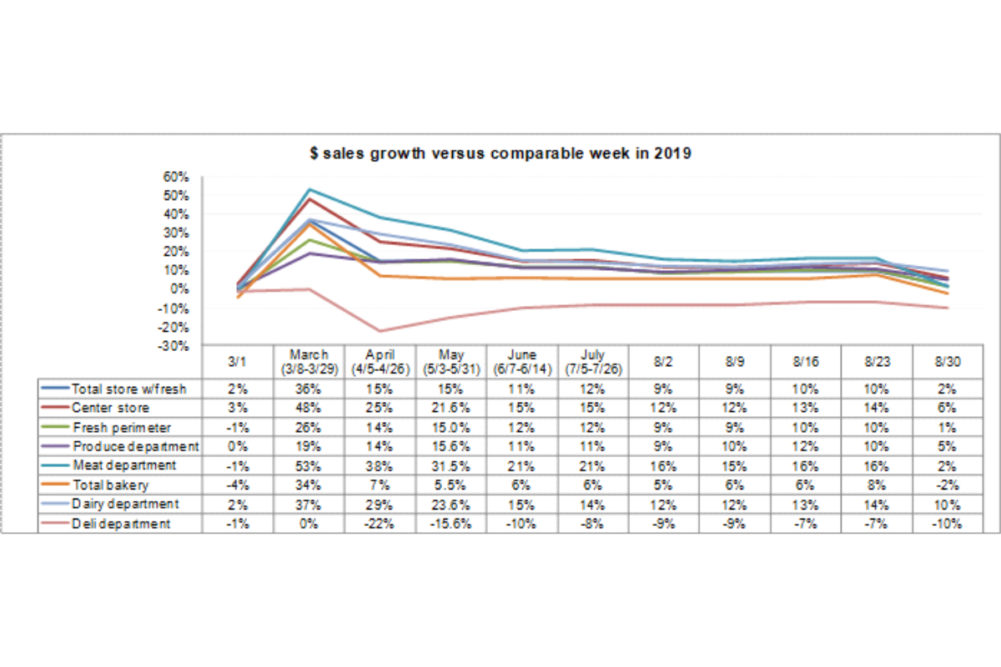

SAN ANTONIO – For the first time since the start of the pandemic perimeter dollar sales gains over 2020 dropped below 10%. The week of Aug. 30, the overall perimeter only drew in a 1% sales gain over 2019, according to data collected and analyzed by 210 Analytics and IRI.

The significant drop in sales gains can likely be attributed to the fact that the last week of August in 2019 contained the Labor Day weekend holiday, whereas this year Labor Day weekend fell a week later.

“At first glance, these numbers look a bit worrisome after weeks of sitting comfortably above last year’s levels in dairy, deli meat, deli cheese and packaged baked goods,” said Jeremy Johnson, vice president of education for the International Dairy Deli Bakery Association (IDDBA). “However, we have to keep in mind that sales went up against one of the biggest grocery holidays of the year in Labor Day 2019. To still see everyday demand push sales above year-ago holiday levels is actually quite an accomplishment, with healthy gains for dairy in particular. I suspect we are going to see some big numbers in next week’s report when the 2020 Labor Day performance will be covered.”

The dairy department performed well with a 10% gain in dollar sales compared to 2019 the week of Aug. 30. Top performers in the category were whipped toppings (up 15.8%), natural cheese (up 12.7%) and eggs (up 10%).

The deli department came in 10% below 2019 sales numbers. Deli prepared came in at 22% below 2019 sales with deli meat at 8% above and deli cheese at 5% above.

“Survey after survey we do at IRI, consumers tell us that they are looking for a little help in the kitchen,” said Jonna Parker, team lead for IRI Fresh. “As the grocery industry, we have a big opportunity to be a helping hand, whether that is providing a new recipe or ideas on how to combine semi- and fully-prepared items with items consumers cook from scratch.”

Bakery sales were still down further the week of Aug. 30, coming in at 13.8% below 2019 sales. Donuts held down the category, coming in at 36.6% below 2019 levels and rolls were down 19.6%. Croissants were the best performer in the category, up 2.7%.

The meat category also saw a significant drop in sales coming in only 2% above 2019 dollar sales and 6% below volume sales. Dollar wise, lamb (up 24.4% was the top performing meat. Beef was up 1.2%, chicken was up 7.1% and turkey was up 8.7% and pork was down 8.4%.

In the produce category, dollar sales gains totaled 4.7% the week of Aug. 30. Fresh vegetables are still outperforming fresh fruit, with vegetable sales up 8.3% and fruit sales up 1.4%. The top performers in the department were cherries (up 33.4%), limes (up 31%) and mushrooms (up 17.8%).

“At first sight these results look surprisingly low after settling into a comfortable 10 percentage points above last year’s levels for weeks on end,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “However, when realizing this week is going up against the Labor Day performance in 2019, the near 5% gain is actually quite remarkable. It indicates that today’s everyday fresh produce demand actually lies higher than last year’s holiday demand, particularly on the vegetable side.”

Next week, 210 Analytics will release the last of its weekly series of perimeter sales category performance results, before continuing the series on a monthly basis.