WESTCHESTER, ILL. — Investments in recent years testify to the faith Ingredion, Inc. has in the future of specialty ingredients.

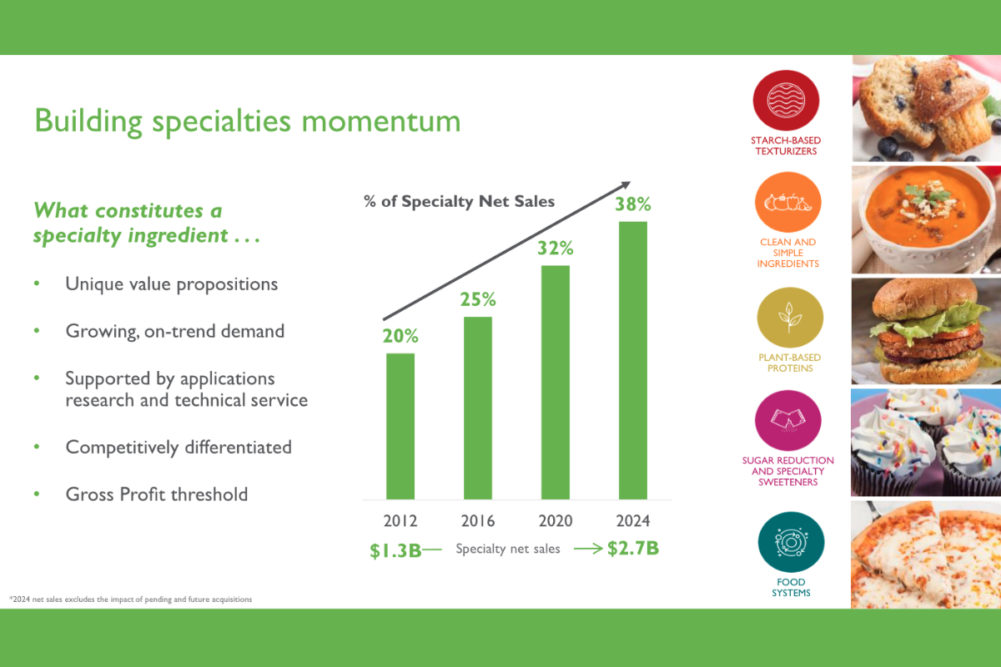

“Over the last eight years, we've steadily increased the percentage that higher-value specialties represent, up from 20% in 2012 to 32% in 2020, with an operating goal to have specialties reach $2.7 billion and comprise 38% of net sales by 2024,” said James P. Zallie, president and chief executive officer, on Feb. 16 in the Consumer Analyst Group of New York virtual conference. “These products have unique value propositions. They're typically growing above GDP (gross domestic product) as they're aligned with market trends and consumer preferences, and they meet a higher internal gross profit threshold.”

Ingredion organizes the specialty ingredients into five platforms: starch-based texturizers, clean and simple ingredients, plant-based proteins, sugar reduction and specialty sweeteners, and food systems.

Ingredion has invested $600 million over the past three years to establish a significant position in plant-based proteins, to become a leader in stevia-based ingredients for sugar reduction, and to diversify and expand beyond corn starches into potato, rice and tapioca starches.

“The two most significant global megatrends where we are investing are plant-based proteins and sugar reduction,” Mr. Zallie said. “In the case of plant-based proteins, it is a rapidly growing category supported by consumers that are mindful of the environment, animal welfare, sustainability and digestive health. Sugar reduction is a global goal on the part not only of consumers, but governments and health professionals to curb the rise in obesity and diabetes.

“Ingredion has made a significant commitment to having plant-based and animal alternative proteins be a new growth path in our specialties portfolio. The $250 million we have invested is against the market size estimated at $13.4 billion by 2024.”

To expand Ingredion’s plant-based capabilities, facilities in Nebraska and Saskatchewan will become food-grade certified in the first half of this year. The company’s plant-based proteins platform is expected to reach sales of over $130 million by 2024, said James D. Gray, executive vice president and chief financial officer.

“In 2021, we will incur approximately $20 million of operating costs to the bottom line as we fully staff and run these facilities,” Mr. Gray said. “As revenue builds, we expect to cover these costs and grow the bottom line into double-digit operating margins or higher.”

Last year Ingredion acquired PureCircle to become a bigger player in the global stevia market, which is estimated to reach $1.6 billion by 2028.

Within Ingredion’s cash flow, 35% is available for strategic value creation, Mr. Zallie said.

“We've deployed our cash in recent years to expand into specialty potato and rice starches and hydrocolloids to enhance our texturizing capabilities; plant-based proteins with the acquisition last year of Verdient Foods; and sugar reduction also this past year with the acquisition of the leader in natural stevia-based, high-intensity sweeteners, PureCircle,” Mr. Zallie said. “You can expect us to continue to pursue and make organic and inorganic growth investments that expand the breadth and depth of our specialties portfolio.”

Despite COVID-19, specialty ingredients sales grew in constant currency in every geographic region in the past year, Mr. Zallie said. Because of the pandemic, Ingredion conducted more than 1,300 virtual consumer meetings over the past nine months, he said, adding the company turned culinary kitchens into digital studios to live stream product formulating and conducted simultaneous taste-testing with customers.