The seafood industry has rebounded strongly from COVID-related disruptions, and the forecast for the coming years is a bright one.

Those are among the highlights of a new study of the global seafood industry by industry analyst Rabobank.

Global seafood trade flows added another $13 billion in 2021, teaching a new peak of more than $164 billion, according to the study.

“We expect the strong rebound in the value of global seafood trade flows to continue as the world emerges from the Covid-19 pandemic,” according to Rabobank. “Major markets like the US and Europe have fully recovered, while China is gradually returning to pre-pandemic import levels.”

Post-pandemic, the salmon industry’s value has been fueled by high prices due to increasing demand and restricted supply growth. But expansion of volumes will be essential for continued growth, according to the report.

The shrimp trade, meanwhile, is at an inflection point, with falling demand likely to cause a short-term trade decline.

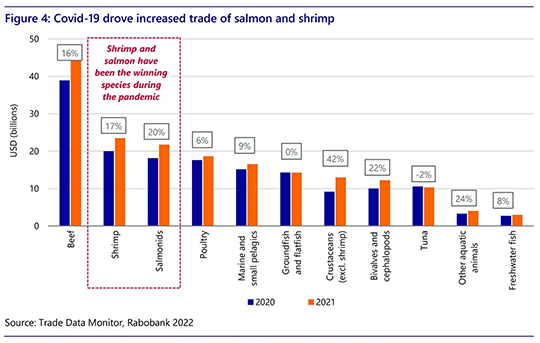

In 2021, seafood trade was roughly 3.6 times the size of beef trade (the second most traded animal protein), five times the size of global pork trade, and eight times the size of poultry trade, signifying the importance of trade for the seafood sector, according to Rabobank.

As the firm’s recently published World Seafood Map makes clear, global seafood trade is characterized by a broad diversity of products, with each having its own export and import markets.

“There are 55 trade flows that are each valued at over $400 million per year and an additional 19 trade flows that are valued between $200 million and $400 million, illustrating the international nature and diversity of seafood trade,” according to the study. “Developing countries play a major role in seafood exports, accounting for seven of the top 10 exporters.”

Developed countries are increasingly reliant on developing nations for imports of high-value species, especially shrimp from India and Ecuador and salmonids from Chile. A more detailed look into specific trade flows reveals that trade from Norway to the EU-27+UK retains the top spot, valued at over $8.7 billion and largely comprised of farmed salmon.

In second place, Rabobank found that trade from Canada to the US is valued at $5 billion and dominated by crustaceans (excluding shrimp), which are valued at $3.34 billion.

And with more than $3.3 billion worth of seafood in 2021, trade from India to the US comes in third place, driven by demand for farmed Vannamei shrimp, which make up 80% of Indian seafood exports to the US.

The combined imports of the US, China, and EU-27+UK are valued at $80 billion, roughly 50% of total seafood trade in 2021. The EU-27+UK remains the largest seafood buyer by value, importing seafood worth over $34 billion in 2021.

However, since 2013, it has grown at a CAGR of only 2%, while in the last five years, the US and China exhibited CAGRs of 6% and 10%, respectively, each roughly doubling the total value of their imports.

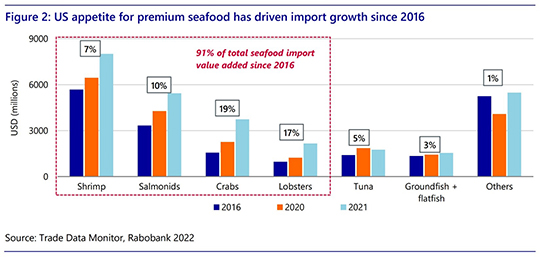

As of 2021, total US seafood imports were valued at $28.1 billion, $8.6 billion higher than 2016 total imports and driven by shrimp, salmonids, crabs, and lobsters, which account for 91% of total value added.

Demand for premium products climbs

US demand for premium seafood is visible in its increasing imports of shrimp, salmonids, and crabs, which exhibited value CAGRs (2016-2021) of 7.1%, 10.3%, and 19%, respectively.

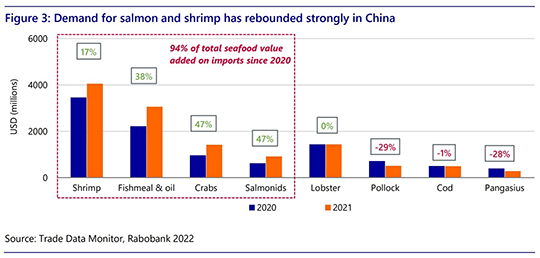

In 2021, China’s seafood imports were valued at $17.2 billion. From 2013 to 2021, China’s import volumes exhibited a CAGR of 4.4%, while import values had a CAGR of 10.1%, highlighting the demand shift to more expensive forms of seafood protein.

This trend is further evidenced by the strong rebound in imports in 2021 that followed the initial Covid-19 lockdowns and added $2.4 billion compared to 2020. This growth was driven by shrimp, fishmeal, crabs, and salmonids, all of which exhibited high double-digit year-on-year growth and together accounted for 94% of import growth.

Since 2013, the winners of global seafood trade have been high-value species such as shrimp and salmonids, which exhibited volume CAGRs of 6% and 2% and value CAGRs of 3.3% and 2.8%, respectively. During the pandemic, we saw higher-value proteins such as beef, shrimp, and salmonids outperform other proteins, with year-on-year growth in trade value of 16%, 17%, and 20%, respectively.

“We expect sustainability and demand for healthy and premium species to continue driving trade volumes of high-value seafood in the coming years, and exporters such as India and Ecuador are well positioned to capitalize on emerging trends and close the gap in the exporter rankings,” according to Rabobank. “We are also seeing unprecedented high prices for many seafood species due to challenges in international trade such as rising freight and energy costs and continued lockdowns in China.”

However, recent data suggests the impact on seafood demand may become material especially if a recessionary environment develops in 2023. This could affect seafood market prices and the value of trade flows.