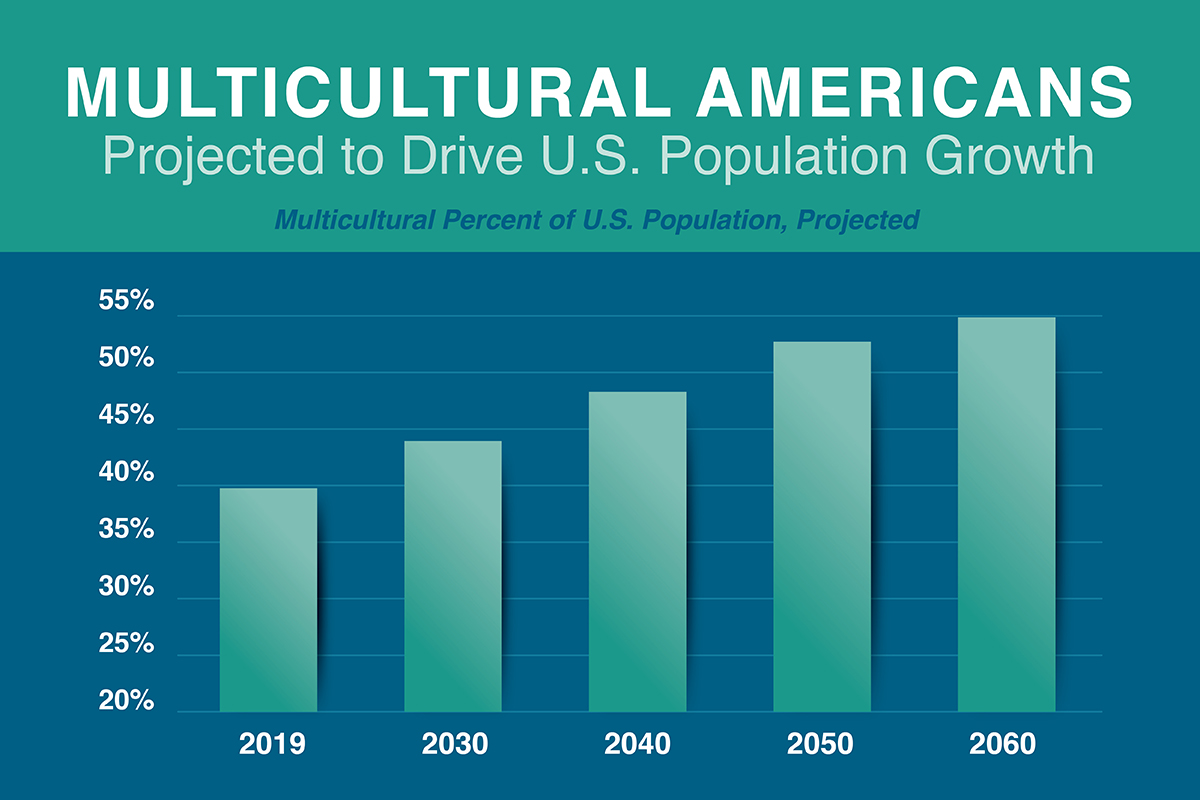

Multicultural shoppers across Asian American, Black, and Hispanic segments are set to significantly increase purchasing power at retail over the next 40 years as the multicultural consumer population in America continues to grow. The United States is projected to be a multicultural-majority nation by 2044. Cargill’s Protein North America marketing and insights team is leading the way in understanding the preferences and shopping behaviors of these growing consumer segments and the impact to retailers, and specifically the fresh meat case.

“Multicultural households coupled with younger consumers’ growing interest in cultural cuisines is driving demand for diverse and authentic ingredients and recipes,” said Susan Breeden, Cargill Protein North America, Multicultural Category Manager. “This evolution in the diversity of America’s palate is creating a wave of innovation and opportunity for retailers to appeal to multicultural shoppers.”

Multicultural Consumer Growth & Demand

In response to growing demand, the fresh protein retail business model is changing. Fresh protein is often considered one of the most important ingredients or elements of a dish, and the right assortment can unlock purchases throughout the store. Data from a leading U.S. retailer showed that the value of a consumer’s basket nearly doubled in size if that consumer was purchasing meat.

While there are commonalities, there are also distinct and unique shopping behaviors among these growing multicultural consumer segments. Retailers will benefit from developing a depth of consumer understanding, from insights such as those from Cargill, versus adopting a one-size-fits-all approach.

Source: Cargill

Source: CargillBlack Americans’ Appreciation for Food Means New Experiences

A growing and vibrant population, Black consumers currently represent 41 million of the U.S. population and are expected to grow to 55 million by 2060.

Source: Cargill

Source: CargillCompared to other demographic segments, Black consumers are making multiple grocery trips per week, largely at non-traditional grocery stores, seeking out brand names and convenience meals. When making purchasing decisions, in-store influences including knowledgeable sales associates, sampling opportunities, and protein innovation drive purchase.

With healthy eating top-of-mind, Black Americans are purchasing a variety of proteins, but are leading users of turkey being four times more likely to buy legs and wings, and one and a half times more likely to buy turkey sausage and patties.

Nearly half of Black consumers note that when shopping they are purchasing more groceries than what was on their list, indicating an opportunity for retailers to merchandise core products such as turkey, along with other relevant products and ingredients to help them easily complete a meal.

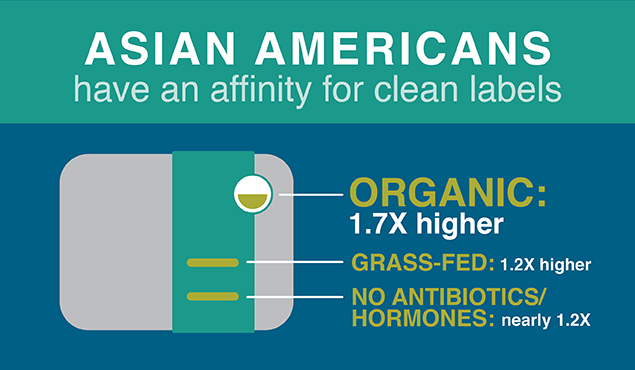

Asian Americans Have Affinity for Clean Labels

Consumers identifying as Asian currently represent 20 million of the U.S. population with that number estimated to double by 2060. Indian and Chinese Americans account for nearly half of the diverse total population, which is also younger than the U.S. average.

Culture is of particular importance to Asian Americans, with holidays serving as an opportunity to celebrate distinct cultural traditions and celebrations that vary by country of origin. For example, many South Asian communities celebrate holidays such as Diwali and Holi, while East Asian communities celebrate the Lunar New Year.

The majority of Asian Americans are shopping from traditional grocery and club stores, but when shopping, place particular importance on fresh ingredients and clean labels, seeking proteins such as beef that is grass-fed or organic. From sustainable raising practices to recyclable packaging, there is a high importance on ensuring this important meal component is produced responsibly. Retailers may consider providing information on the traceability and sourcing of their proteins to help further inform and influence this segment’s purchases.

Source: Cargill

Source: CargillHispanics Celebrate Heritage with Beef

Hispanics represent nearly half of all multicultural consumers in the U.S. and are projected to be more than one-quarter of the U.S. population by 2060. Additionally, as the Hispanic population continues to grow, its impact on the larger cultural cuisine in the U.S. is strong as well. In fact, for the first time ever, Hispanic food is the favorite multicultural cuisine among younger consumers and even preferred over Italian dishes, a chance for retailers to educate, inspire, and inform mainstream consumers on the use cases of fresh meat products utilized in Hispanic recipes.

Source: Cargill

Source: CargillHispanic consumers celebrate heritage, tradition, and family with beef, whether they reach for cheek meat and brisket to make Barbacoa, or thin-sliced steak and carne picada for tacos, influencing their spend on meat purchases, 9 percent more than other consumer groups. Despite fresh meat and specifically beef being a central part of celebrating their heritage, Hispanics under index in shopping at traditional grocery stores signaling an opportunity to retailers to evaluate their assortment and offerings and to pay close attention to Hispanic consumers’ country of origin which greatly influences purchasing behaviors.

Cargill’s Rumba Meats® brand which focuses on celebrating Hispanic tradition and family, recognizes Hispanic contributions and impact on American culture throughout the year offering a variety of authentic cuts of meat for the most beloved recipes from across Hispanic cultures.

“Whether we are providing our retail partners with insights on assortment, consulting on bilingual product naming, or offering strategic insights on evolving consumer behaviors, they can always lean on us to help them better serve the multicultural shopper and achieve meaningful growth,” said Tammy Gonzales, Cargill Protein North America, Multicultural Marketing Manager.

To learn more, contact your Cargill sales representative.

Sources: U.S. Census Bureau, 2019 American Community Survey. 2017 National Population Projections. Bureau of Economic Analysis, Current Population Survey, Collage Group Network Analysis. Shopper card data from a leading U.S. retailer, April 2022. Simmons/MRI, October 2021. Collage Group Category Essentials Spring 2022, Holidays & Occasions Survey, May 2021, Passion Points Survey, January 221. Top 10 Things to Know About Asian Consumers, June 2022. Numerator Consumer Panel Data, May & July 2022. Nielsen Homescan Panel Data, April 2021. Cargill Proprietary Research, July 2018, November 2020 & January 2020. Datassential Annual Trends, 2022.