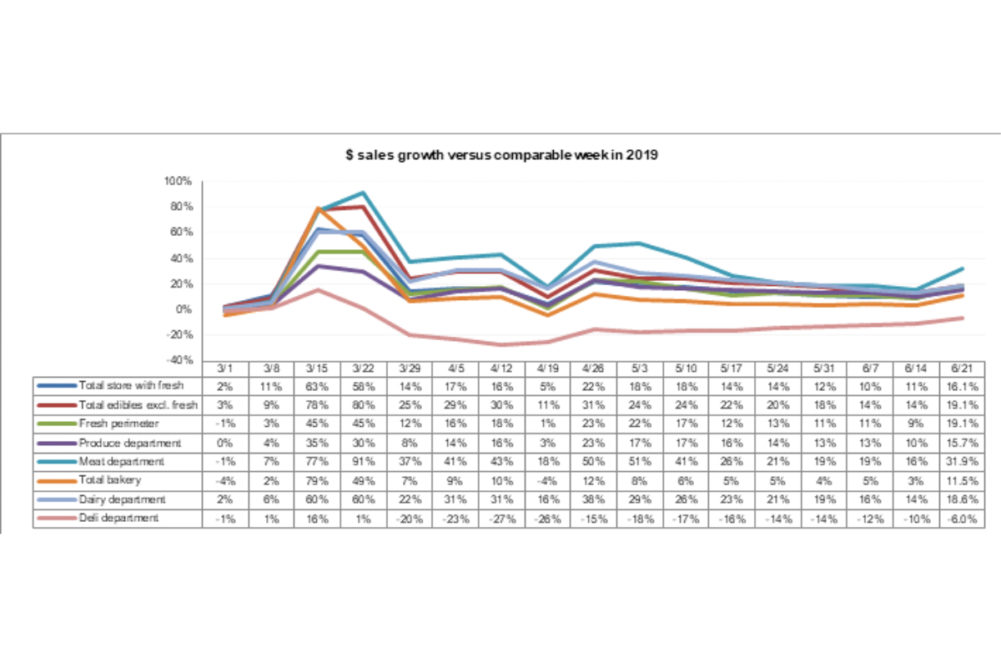

SAN ANTONIO – Father’s Day weekend typically provides a sales boost across fresh departments, and the coronavirus (COVID-19) pandemic didn’t stop that trend. Sales for the week ending on June 21 were elevated to higher levels than they have been for the last several weeks.

According to the latest data from 210 Analytics and IRI, the total fresh perimeter experienced an 19.1% jump in sales over the same timeframe in 2019 the week ending on June 14, compared to an 8.7% bump the previous week.

“We had high hopes for Father’s Day week and the numbers did not disappoint,” said Jeremy Johnson, vice president of education for the International Dairy Deli Bakery Association (IDDBA). “We had several very important firsts this week. The recovery in fresh baked goods continued. Father’s Day celebrations prompted positive gains for the instore bakery over last year’s levels for the first time since mid-March.

“Second, strong performance by deli meat and cheese and continued recovery by deli prepared prompted a single-digit loss for the total deli department for the first time since the onset of coronavirus in the US. Now the question becomes how we can maintain this momentum in a non-holiday week. As consumers are out of ideas for the many at-home meal occasions, meal solutions and ideation are a big part of the answer.”

The dairy department experienced a 18.6% gain in dollar sales compared to 2019. Top performers in the category were whipped toppings (up 36.2%), eggs (up 29.2%) and cream cheese (up 28.9%). Natural cheese was up 24.2% and processed cheese was up 20.3%.

Although still reduced from the same timeframe in 2019, the deli department had a successful week, with a sales decline of 6%. Within the department, deli cheese was up 16.8%, deli meat was up by 11.8% and deli prepared foods were down 18.7% — the lowest loss since the week of March 15.

“With restaurant competition heating back up, decisions relative to assortment and pricing are crucial right now,” said Eric Richard, industry relations coordinator with IDDBA. “It is important to answer the demand for convenient, ready-to-eat meals with relevant assortment and attractive value propositions. Frozen food entrees have seen an extremely strong couple of months and restaurant transactions are growing each week. At the same time, the new normal provides us with the opportunity to re-evaluate line extensions and focus on high velocity, highly profitable items that helps us differentiate from the competition.”

Father’s Day weekend also gave the instore bakery a much-needed boost. For the first time since the week of March 15, the instore bakery exceeded 2019 sales numbers at a 3% increase. Within the department sweet snacks like donuts (up 14.2%, pastries (up 15.7%) and packaged baked goods (up 14.1%) did well for the first time since the start of the pandemic.

Still a strong performer, the meat category in the second week of June totaled dollar sales 31.9% above 2019 sales. Although volume sales gains were only up 13.9% for the category, and the heightened dollar sales continue to derive from enhanced meat prices across the category.

Dollar wise, lamb (up 51.3%), beef (41.6) and pork (up 36.2%) were the top performing meats. Chicken was up 16.1% and turkey was up 20.6%.

In the produce category dollar sales were up 15.7%. Fresh vegetables are still outperforming fresh fruit with vegetable sales up 20.7% and fruit sales up 11.2%. The top performers in the department were oranges (up 63.2%), mushrooms (up 32%) and tomatoes (up 29.5%).

“We expected Father’s Day week to provide an above-average boost and it sure did,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “The bump put us right back at mid-April levels with double-digit gains for both fruit and vegetables. There is a valuable lesson in this for holidays to come. Consumers are still celebrating, but most are doing so at home in smaller numbers — boosting grocery spending far above prior year levels. This means we have to adapt our merchandising and marketing tactics accordingly.”