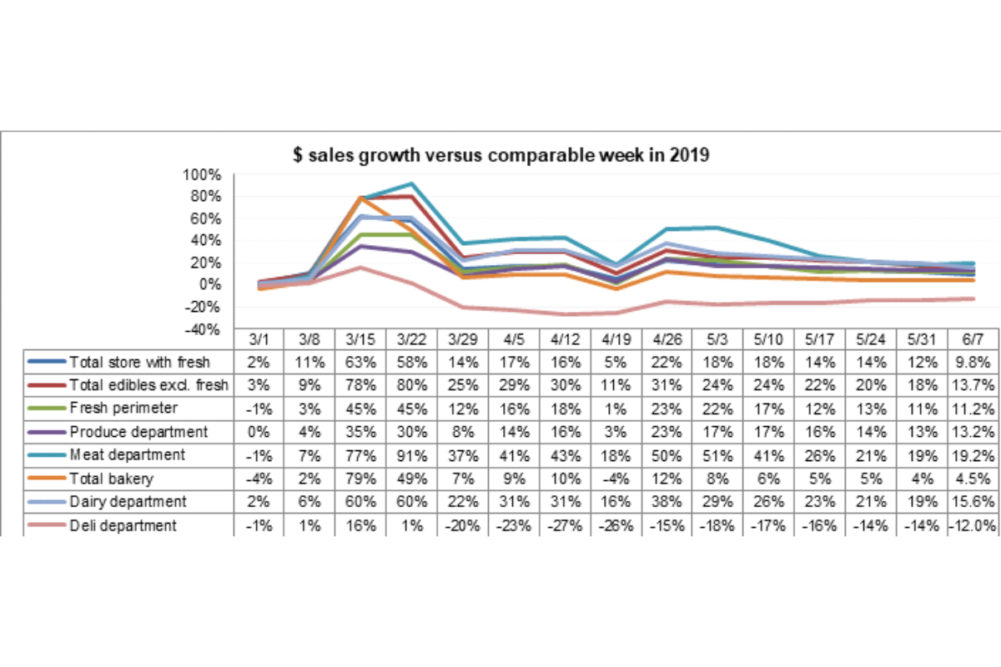

SAN ANTONIO – Above-average sales across the meat, dairy and produce departments continued into June, according to the latest data from 210 Analytics and IRI, with the total fresh perimeter experiencing an 11.2% jump in sales over the same timeframe in 2019.

“The slow march to normalcy continued during the first week of June, but sales remained well above last year’s baseline for most departments,” said Jeremy Johnson, vice president of education for the International Dairy Deli Bakery Association (IDDBA). “June starts off with continued strength for dairy and deli sales continue to make a comeback week after week. As summer sales patterns are in full swing, but holiday celebrations will still look very different, it is important for all these departments to be high on the consumer radar with relevant and value-focused offers.”

The dairy department experienced a 15.6% gain in dollar sales compared to 2019. Top performers in the category were whipped toppings (up 28.7%), eggs (up 37.7%) and butter (up 24.1%). Natural cheese was up 23.2%, while processed cheese was up 13.1%.

Like in previous weeks, the bakery and deli departments were still struggling in the week leading up to June 7. The deli department continues to see mixed results. Overall, department sales were down 13.5%. Deli cheese was up at 11.1%, deli meat was up by 6% and deli prepared foods were down 26.8%.

“Deli prepared is making a slow but steady comeback,” said Eric Richard, industry relations coordinator with IDDBA. “Retailers are finding solutions to bring time-saving items in ways that work for consumers, avoiding self-serve options and kiosks. Some retailers have started to remove salad and olive bars, others have reopened them as employee-served bars with minor alterations and others are repurposing buffet-style hot or cold bars into packaged food buffets with a variety of items and sizes.”

Instore bakeries continued to see lower sales than normal with the whole department down 12% the week of June 7. Within the department donuts (down 48.1%), rolls (down 13.7%) and cakes (down 9.8%) are most impacting the category. Bread and croissants continued to perform well, up 7.9% and 7.5%, respectively.

Still a strong performer, the meat category in the week ending on June 7 totaled dollar sales 19.2% above 2019 sales. Lamb (up 39.3%) and turkey (up 31.4%) were the top performing meats. Beef was up 23.2%, chicken was up 13.8% and lamb was up 20.8%.

“Plentiful protein supplies and lackluster foodservice interest continue to weigh on beef, pork and chicken values,” said Christine McCracken, executive director of food and agribusiness for Rabobank.

“Wholesale beef prices fell sharply the first week of June (down 19% from last week) as harvest levels averaged just 2% below year-ago. Pork prices also moved lower (down 8% from the prior week) on another strong week of production. We expect harvest levels to remain elevated throughout the summer as packers work through the backlog of pigs delayed due to plant closures. Chicken prices remain depressed (down 2% versus last week), despite estimated slaughter down 6% from a year ago as the impact of production cuts begin to take effect. We expect further production declines in the coming week and for prices to begin to stabilize.”

In the produce category dollar sales were up 13.2%. Fresh vegetables are still outperforming fresh fruit, with vegetable sales up 17.1% and fruit sales up 10%. The top performers in the department were cherries (up 79.2%), oranges (up 57.4%) and mushrooms (up 29.1%). Potatoes, peppers and tomatoes also saw sales numbers elevated by 20% or more.

“The fresh produce industry is resilient,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “Throughout the COVID-19 crisis, retail has been the primary option for consumers to engage with fresh produce. As restaurant reopening across the country is bringing foodservice back online, demand is growing stronger each week. Understanding the changes and challenges ahead for our industry is of critical importance and staying connected on how we will worth together will bring forth successful solutions for all.”