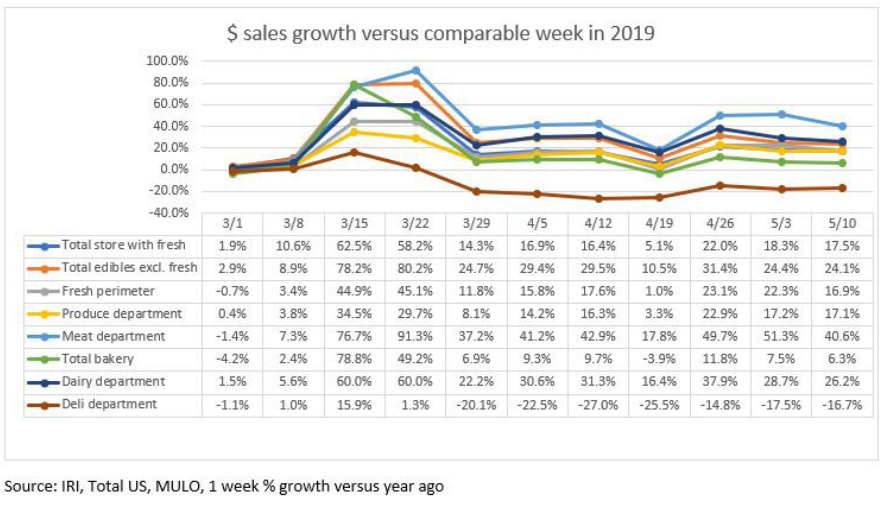

SAN ANTONIO – Entering the second week of May elevated grocery sales continued in most of the fresh perimeter departments. Data from 210 Analytics and IRI shows sales in the fresh perimeter for the week ending on May 10 were 16.9% above sales during the same timeframe in 2019, down from the previous week, which saw sales elevated by 22.3%.

The meat department remained a strong performer with dollar sales up 40.6% coming into the first week of May. Pork (up 50.3%) and beef (up 47%) were the top performing meats. Chicken was up 31.1%, turkey was up 33.1% and lamb was down 9.8%.

There was a significant gap between dollars and volume sales growth, with the entire meat category seeing volume sales up by 27.8%. The widest gap among products was a 15.4% gap between turkey dollar and volume sales followed by an 11.3% gap for beef and a 10.4% gap for pork and lamb.

“Beef and pork plants are back online, but remain at least 15% short on labor,” said Christine McCracken, executive director of food and agribusiness for Raboban. “Workers vulnerable to the virus or with at-risk family members may be unwilling to return to their former positions. We expect absenteeism to fall but anticipate labor constraints to limit processors’ ability to debone and trim.”

Dairy saw a sales boost of 26.2% over 2019 sales the week of May 10. Top performers in the category were butter (up 58.3%), whipped toppings (up 40.9%) and eggs (up 39.1%). Natural cheese was up 35.5%, while processed cheese was up 26.2%.

“The week ending May 10 was Mother’s Day week,” said Jeremy Johnson, vice president of education for the International Dairy Deli Bakery Association (IDDBA). “Mother’s Day has traditionally been the biggest day for eating out all year, but with restaurants closed or operating with limited capacity, this was the year of grocery retailing. The summer has many more holidays and celebrations and they each provide a big opportunity for the dairy, bakery and deli departments to shine.”

Produce dollar sales were up 17.1%. Fresh vegetables are still outperforming fresh fruit, with vegetable sales up 23.1% and fruit sales up 11.7%. The top performers in the department were oranges (up 69.2%), potatoes (up 41%) and mushrooms (up 35.4%). Peppers, onions, and tomatoes also saw sales numbers elevated by 20% or more.

“We have seen double-digit increases for fresh produce seven out of the past nine weeks,” said Joe Watson, vice president of membership and engagement for the Produce Marketing Association (PMA). “I am encouraged to see another week of 17% year-over-year growth. In addition to the elevated everyday demand because of more at-home meal occasions, the summer season has many holidays and celebrations, opportunity for backyard cookouts and slowly getting families and friends back together. As the meat department is challenged to add items for the weekly circular amid current shortages, the pressure is on the produce department to carry the front page. Let’s put the many summer fruits and vegetables in the spotlight.”

Like in previous weeks, the bakery and deli departments were still struggling in the week leading up to May 10. The deli department continues to see mixed results. Overall, department sales were down 16.7%. Deli cheese was up at 15.6%, deli meat was up by 5% and deli prepared foods were down 32.8%.

“A check on slot availability across various restaurant reservation and delivery platforms showed consumers still engaged highly with restaurants albeit in a different way this year,” said Eric Richard, industry relations coordinator with IDDBA. “While we also saw a nice boost in other departments, deli-prepared did not benefit from the different Mother’s Day celebrations. Instead, we are seeing the establishing of patterns across areas. Pre-packaged meals is back in positive territory, which is an important lesson, but all other areas continued to struggle. Combo meals, trays and soup in particular.”

Instore bakeries continued to see mixed results as well, resulting in entire department sales being down 14.5%. Within the department donuts (down 51.1%), cakes (down 11.9%) and rolls (down 12.7%) are most impacting the category. Bread and croissants continued to perform well, up 9.7% and 3.8%, respectively.

“Next week’s sales report, covering week 10 of coronavirus in the U.S, is likely to be a pivotal point in the process of establishing what the next several months will look like,” said Anne-Marie Roerink, president of 210 Analytics. “Nearly all US states have started to partially re-open or have plans to do so. As states begin to enter their various re-opening phases, the economic and social readiness of consumers to re-engage with foodservice will become clearer. For the foreseeable future, it is likely that grocery retailing will continue to capture an above-average share of the food dollar.”